Rent refers to that part of payment by a tenant which is made only for the use of land, i.e., free gift of nature. The payment made by an agriculturist tenant to the landlord is not necessarily equals to the economic rent. A part of this payment may consist of interest on capital invested in the land by the landlord in the form of buildings, fences, tube wells, etc. The term ’economic rent’ refers to that part of payment which is made for the use of land only, and the total payment made by a tenant to the landlord is called ‘contract rent’.

In economics, the term ‘rent’ is being increasingly used in the sense of a surplus, i.e., what a factor of production earns over and above what is essential to maintain its supplies in its present occupation. In this sense, rent can arise only when the supply of a factor of production is less than perfectly elastic, and this is the case with most of the factors. In case the supply of a factor is perfectly elastic, it cannot earn any surplus over and above its supply price. Because whenever such a factor is found to be earning more than its supply price, more units of this factor will rush in and the surplus earning will disappear. This is so because, under perfect competition, the market price of a factor must equal its supply price.

The supply of land in general is absolutely inelastic, and its supply is independent of what it earns. The higher rent cannot attract more of it and a lower rent cannot drive it out. That is why, the land has no supply price.

Economic rent is the surplus which remains to the supplier of a factor after he has paid all the expenses of production and has remunerated himself for his own productive effort.

Another way of explaining rent is transfer earnings. Transfer earnings represent the amount which a factor can earn in its next best paid alternative use. Suppose a piece of land yields in its present use Rs. 500,000 a year and suppose further that if it is transferred to its next best use, it will yield Rs. 400,000. In its present use, it yields Rs. 100,000 more than its next best use. This sum of Rs. 100,000 is a sort of surplus that the land is yielding in its present use. This surplus is called rent.

Ricardian Theory of Rent:

More than a century ago, David Ricardo presented the Theory of Rent. According to him, rent is that portion of the produce of the earth which is paid to the land for the use of the original and indestructible powers of the soil. Economic rent, according to Ricardo, is the true surplus left after the expenses of cultivation as represented by payments to labour, capital and enterprise have been met.

Suppose a country has four kinds of land, i.e., A, B, C and D. Some pieces of land are more fertile than others and some areas are more advantageously situated as regards centres of population and means of transport, etc. A is most superior land and B, C and D are 2nd, 3rd and 4th grade lands, respectively. Further, suppose that standard units of labour and capital called ‘doses’ of labour and capital, when applied to these categories of land, produce wheat as given in the following table:

Doses | Return in Quintals of Wheat per Acre | |||

A | B | C | D | |

1st | 10 | 9 | 8 | 7 |

2nd | 9 | 8 | 7 | 6 |

3rd | 8 | 7 | 6 | 5 |

4th | 7 | 6 | 5 | 4 |

5th | 6 | 5 | 4 | 3 |

6th | 5 | 4 | 3 | 2 |

Suppose class A is enough and it can meet the entire demand for food at the prevailing price. In this situation, land will command no rent. It will be like a free gift of nature. Now suppose that population has increased to such an extent that the whole of the class A land is brought under cultivation, and still it is not enough to meet the growing demand for food. In order to meet the increased demand for food, more labour and capital will be put into lands of class A, and of class B will also be brought under cultivation. This will happen only when the price of wheat rises so much as to make it worthwhile putting one more dose (i.e., two doses in all) of labour and capital into land A and putting first dose of labour and capital into land B. The price of 10 quintals of wheat produced on land A in 1st dose of labour and capital is just equal to the cost of labour and capital. Therefore, there is no surplus on land A in the first dose. Similarly, the price of 9 quintals of wheat produced on land B is just equal to the cost of labour and capital put into this land in the 1st dose. Therefore, there is no surplus on land B in the second dose. But on the land A, 2nddose of labour and capital gives a return of (10 + 9) 19 quintals, whereas, the cost of two doses labour and capital is just equal to (9 quintals × 2 doses) 18 quintals. The difference of 1 quintal (19 – 18) is the surplus on land A. Thus the cultivators of land can either cultivate land B free of rent and get 9 quintals of wheat per dose of labour and capital per acre, or they can pay 1 quintal of wheat per acre to the owners of land A as ‘rent’.

As the demand for food still grows and the price of wheat rises, this process will continue. More and more units of labour and capital will be applied to the superior lands on the one hand, and still inferior lands will be brought under cultivation, on the other. The available doses of labour and capital will be applied in such a way as to get equal returns at the margin of cultivation. For example, if there are 10 doses available, 4 will be applied to land A, 3 will be applied to land B, 2 will be applied to land C, and 1 dose will be applied to land D. In this way, the marginal or the last dose applied to each class of land will give the same return, i.e., 7 quintals of wheat. The total production under these conditions will be 34 + 24 + 15 + 7 = 80 quintals of wheat. No other arrangement can give an output more than this. It is clear that rent of each class of land is equal to the surplus output over and above the cost of production, which is equal to 7 quintals of wheat. Under such circumstances, rent per acre of the various kinds of land will be:

Rent of A = Total Produce of Land A – Total Cost of Production from Land A

= (10 + 9 + 8 + 7) – (7 quintals × 4 doses)

= 34 – 28

= 6 quintals

Rent of B = (9 + 8 + 7) – (7 quintals × 3 doses)

= 24 – 21

= 3 quintals

Rent of C = (8 + 7) – (7 quintals × 2 doses)

= 15 – 14

= 1 quintal

Rent of D = 0 quintals

When marginal produce is 7 quintals, there will be no rent of D grade land. It is then the marginal land or land on the margin of cultivation. This is also called the ‘no-rent land’ or ‘marginal land’. It produces no surplus over cost of production. Its produce is just enough to cover production expenses on it. The rent of all superior lands is measured upwards from, and with reference to, the marginal land. Now the marginal land may not be the worst or poorest land. It may have other alternative uses. The land which is best for cultivation of cotton may also be best for cultivation of wheat.

The following diagrams illustrates the Ricardian Theory of Rent:

In case of land C, the price will also be OP, because under perfect competition, price in the market must be the same whatever land may be producing that commodity. But the average cost is QS. Hence there is GS per unit surplus, or total surplus above total cost is equal to the area GPTS. GPTS is the rent on land C. Similarly, rent on land B is represented by FPZK and rent on land A is represented by EPJR.

The rent paid may not be economic rent, but scarcity rent. This happens in an old economy with a growing population. Then, even the marginal land pays some rent which is scarcity rent. The superior lands will pay, besides scarcity rent, economic rent, due to the natural differential advantages enjoyed by them.

Besides economic rent, there is also a ‘scarcity rent’. As the price of wheat rises, the worst land is also subjected to intensive cultivation and it yields a surplus over cost. This surplus is not a differential one compared to no-rent land, which does not exist. It is due to the scarcity of land as such. Hence it is called ‘scarcity rent’.

The rent yielded by superior lands thus contains two elements:

(i) Differential surplus over marginal land, and

(ii) Payment due to scarcity of land as such.

Criticism of Ricardian Theory:

The Ricardian Theory of Rent has been widely criticised on the following grounds:

(i) According to Ricardian Theory, rent arises because some lands are superior and others inferior. But modern writers assert that it is a matter of indifference to the general principle of rent whether the land is uniformly good, uniformly bad or gradable. The essential factor of rent is the relative scarcity of the products that land can yield. The scarcity of land is in fact derived from the scarcity of its products. If the problem is approached from this point of view, the necessity of assuming different grades of land disappears.

(ii) The second fact that Ricardian Theory has pointed out is that rent is measured from the no-rent margin. No-rent margin is the starting point of measuring rent according to this theory. It is contended by the modern writers that the no-rent margin may exist in some cases, but it is not fundamental to the emergence of rent. For instance, some lands may be fit only for a specific use, e.g., growing corn. If it is not profitable to grow corn on them due to fall in the price of corn, such land may go out of cultivation, or they may just pay for the cost of the crop grown on them. Such lands may have significance from the point of view of rent but in a different sense than held by Ricardo. If such lands are cultivated, they tend to increase the supply of corn and thus lower rents, and if they go out of cultivation, rent rises due to a decrease in the supply of corn. The existence of such marginal land does not give any ultimate explanation of rent.

Modern Theory of Rent:

Modern theorists view rent as a payment for the use of land. According to the modern view rent is determined by the demand for and the supply of land. Now lets take the demand for land first:

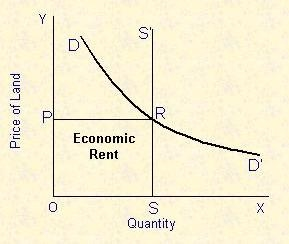

Demand for the Use of Land: The demand for land is a derived demand. It is derived from the demand for the products of land. If the demand for these products rises or falls, the demand for the use of land will correspondingly rise or fall leading to increase or decrease of rents. For instance, if population of a country increases, the demand for food will increase, resulting in increased demand for land and rise in its rent, and vice versa. The productivity of land is subject to the law of diminishing marginal productivity. That is why, the demand curve for land slopes downward from left to right, as shown in the following diagram:

Thus, on the side of demand, rent of land is determined by its productivity, not total productivity, but marginal productivity.

Supply Side: On the supply side, the supply of land is fixed so far as the community is concerned, although individuals can increase their own supply acquiring more land from others or decrease its supply by parting with land. Land is a case of perfectly inelastic supply which means that whatever the rent, the supply remains the same. That is why it is said that land has no supply price. In other words, the supply of land in general is absolutely inelastic and as such its supply is independent of what it earns.

Interaction of Demand and Supply: The interaction of these two forces is shown in the above diagram. We assume that land is homogeneous and it is used for raising only one crop. Only then there can be one demand curve and on supply curve. We also assume perfect competition. SS, supply curve, a vertical straight line, indicates the fixed supply of land. These two curves intersect at point E. In this OR (=SE) is the rent. If the rent is less than OR, say OR” (=SE”), the demand for land will increase; but the supply is fixed, hence rent will again rise to OR. If, on the other hand, rent rises above OR to OR’ (=SE’), the demand for land will decrease and bring the rent back to OR.

Suppose now that on account of increase in population or otherwise, demand for land has increased from DD to D’D’. Supply curve is still the same SS. The new point of intersection will be E’, and, therefore, the rent will be OR’ (SE’). If demand falls to D”D” then the demand and supply curves intersect at E” and the rent will be OR” (SE”). In case, the country is entirely new and land of good quality is surplus, then there will be no rent. This condition is shown by D”’D”’.

Land for an Individual / Particular Use: We have analysed above the total demand and supply of land for the community as a whole. Now lets consider an individual’s case. For a particular use or particular industry, the supply of land cannot be regarded as fixed. By offering more rent, the supply can be increased, the supply will decrease if the rent in this particular case goes down. The supply is thus elastic and the supply curve will rise upward from the left to the right as is shown in the following diagram:

Modern theory of rent does not confine itself to the determination of the reward of only land as a factor of production. Rent according to the modern sense can arise in respect of any factor of production. It is a surplus payment in excess of transfer earnings of that factor. Economic rent of a factor of production is the excess over its transfer earnings, i.e., what a factor may be earning in its present employment over what it could earn in its next best employment. In other words, transfer earnings of a factor mean what a unit of factor can earn in its next best alternative use, occupation or industry. We can also define transfer earnings as the minimum earnings which a unit of factor of production must be paid in order to induce it to stay in its present use or industry or occupation. If a factor is getting less than this minimum, it will give up its present employment and shift to its next best alternative employment. But if a factor in its present employment is earning more than the minimum necessary to keep it in that employment, the excess is called ‘economic rent’.

Let us take some examples, suppose a lecturer in Economics is getting Rs. 10,000 salary per month in a college. His next best employment can be in a bank where he can earn Rs. 9,000 salary per month. If he cannot get Rs. 9,000 salary from college, he will take up a job in a bank. But since he is actually earning Rs. 10,000 as lecturer in a college, it means he is earning Rs. 1,000 per month more than his next best employment.This Rs. 1,000 is an economic rent for him. Take another example, suppose a piece of land is devoted to the cultivation of rice with Rs. 15,000 earning per month. In the next best alternative use, the owner can earn Rs. 12,000 per month by cultivating cotton on it. It means he is earning Rs. 3,000 more than the next best alternative use of land. This excess / surplus of Rs. 3,000 is economic rent.

How Economic Rent Arises?

The determination of Economic Rent depends on the elasticity of supply of factors of production. There are three possibilities:

(a) Perfectly elastic supply of factors

(b) Less than perfectly elastic supply of factors

(c) Inelastic supply of factors

(a) Perfectly elastic supply of factors: When the elasticity of supply of factors of production is perfectly elastic, there will be no surplus or economic rent, and the actual earnings and transfer earnings are equal. If there is any difference, it will be swept away, when new factors are entered into the factor market. When the supply of factors of production is perfectly elastic, it means that entrepreneurs can engage or employ any number of factor units at a given price or remuneration. Thus no factor can earn more than its transfer earnings, and there will be no rent or surplus earnings. This situation is shown in the following diagram:

In the above diagram, the supply curve of the factor of production is a horizontal straight line indicating perfect elasticity. All the factor units are available at the given price OS. The transfer earnings of each factor is equal to OS. DD is the demand curve and it intersects the supply curve SS at point P. OM is the equilibrium quantity of the factor used. Total earnings are equal to OSPM. But since the transfer earnings are equal to total earnings, therefore, the transfer earnings are also equal to OSPM. If this firm does not pay the price OS, the factor units will be shifted to some other use.

(b) Less than perfectly elastic supply: When the elasticity of supply of factors of production is less than perfectly elastic (i.e., it is somewhat elastic), the transfer earnings of all the factors are not equal. As the price of the factor increases, more and more of the factor units will be employed in the industry. Suppose, in a particular industry, a factor unit can earn Rs. 5,000 per month. It is obvious that only such units of the factor will offer their services to this industry whose price in other alternative occupations is less than Rs. 5,000, or in other words, the transfer earnings are less than the present earnings. In this manner, as the price paid for a factor in a particular industry or occupation increases, the supply of the factor will increase if the transfer earnings are less. It is clear that the supply of a factor of production depends on its transfer earnings. The following diagram illustrates the situation:

(c) Inelastic Supply: When the elasticity of supply of factors of production is absolutely inelastic, it means that it is the case of supply of land for the community as a whole. The supply of land for community is fixed and it cannot be increased or decreased whatever the price is offered. That is why the land has no supply price:

The total earnings of land is equal to OPRS. Since in this situation the transfer earnings of land are equal to zero, the entire earning of land, i.e., OPRS, is economic rent. From the point of community as a whole, there are two alternatives, viz., either the land should be cultivated or it should be kept idle. Hence, for the community, the transfer earnings of land are zero and whatever earnings are made in any use thereof constitute its rent or surplus.

Quasi Rent:

The concept of ‘Quasi-Rent’ was first introduced in Economics by Professor Marshall. According to him, quasi-rent is the surplus earned by the instruments of production other than land. The term ‘Rent’ is applied to income from land and other free gifts of nature, and ‘Quasi-Rent’ to the income derived from machines and appliances with the help of human efforts. It is earned during the period when their supply cannot be increased in response to the increase in demand. It is a short-term concept.

The basis of distinction between rent and quasi-rent is the fact that the supply of land is fixed forever, and the other instruments of production, i.e., building, machines, etc, is fixed temporarily and can be altered after some time. Thus, the quasi-rent is a temporary surplus. With the increase in the supply of other instruments of production, i.e., buildings, machines, etc., it disappears. The earnings from such durable goods like machines must, in the long run, equal the prevailing rate of interest. Temporarily, however, due to shortage, they may yield surplus earnings which are called ‘quasi-rent’.

Quasi-rent has also been defined as the excess of total earnings in the short run over the total variable cost:

Quasi Rent = Total Revenue – Total Variable Cost

Rent and Prices:

There are two views regarding the differences in the rent and prices:

(a) Ricardian View: According to Ricardian theory of rent, rent cannot enter into price. It is not an element of cost of production. According to Ricardian theory, rent rises because of the rise in price and not the other way round. According to this theory, rent is a surplus over cost. Price is determined by the cost of production at the margin where there is no rent. Hence, rent does not enter into price. The marginal dose of labour and capital just pays for itself and leaves no surplus.

In fact the position of the margin, according to the Ricardian theory, is determined by price and not price by the position of the margin. Rent is price-determined and not price-determining.

But it is not to be understood that rent has nothing to do with price. When price rises, margin of cultivation will descend; and inferior lands, which it was not worthwhile to cultivate before, will now become worthwhile. The land, which was marginal or no-rent land before, begins yielding a surplus, and hence rent. The lands next inferior to it become the marginal lands. As the margin of cultivation descends, the difference between the superior land and the marginal land becomes greater. This difference is the measure of economic rent. Therefore, we see that when price rises, the rent also rises. This is true even from commonsense point of view. For example, when price of wheat rises, there will be greater demand for land to cultivate wheat and the farmer must offer higher rents to bring more land under the plough.

Thus, rent follows prices but price does not follow rent. Price is the cause and rent is the effect.

(b) Modern View: Modern theorists point out certain cases in which rent will enter into price. When we are thinking not of all the land of the country but of the land available for particular uses, rent does form an element of price. This is clear from the concept of opportunity cost. Most of the land is capable being put to alternative uses. If it is put to one use, it is not available for another use. The minimum price that has to be paid for the use of land is the amount which this land could earn in its most profitable ‘alternative use’. This is called ‘opportunity cost’ or ‘transfer price’.

From the point of view of an individual firm, prices paid for all factors (including the price for the use of land) must of course be included in the cost of production, and must, therefore, enter into price. If a farmer is using land belonging to someone else, the rent that he pays is obviously a cost for him. In the case of an owner-cultivator too, the rent as a cost is there, only its presence is obscured. The payment that he could have received, if he did not cultivate himself, is the opportunity cost of this land.

The problem may be approached in another way. Prices are determined by the scarcity of the product in relation to demand. The rent that an entrepreneur pays is a part of his cost of production. If the rent is high the entrepreneur will tend to hire less land and, conversely, he will use more land if rent is low. If he uses more land, the supply of land for other purposes is diminished. If he uses less land, the supply available for other purposes is increased. This rent by influencing relative scarcity of land for different uses effects the prices of different products.

No comments:

Post a Comment