PROTECTIONISM

The theory

of International Trade based on comparative costs stresses that the benefits of

International Trade can be held by the trading countries only when the trade is

free from all restrictions. But it was

realised soon that the free trade, no doubt, advantageous for developed

countries but it is highly injurious for the developing countries due to the

various reasons. Free trade policy has been generally conducted by the

developing countries and they have utilised the restricted trade policy for the

purpose of providing protection to the local economy against the competition of

developed and technically advanced countries.

Arguments

for Protection:

The

following arguments are extended in favour of protection:

1.

Infant Industry Argument:

This

argument was given by a German economist Friedrich List, according to whom

newly emerging German Industries (infant industries) were in need of protection

against Britain’s develop and establish industries.

2.

Diversification of Industry Argument:

Again, List

was of the opinion that the local Industries could be protected and country may

not depend on a few industries. Otherwise it will have to depend on other

countries which will neither be socially nor economically and nor politically

advisable.

3.

Employment Argument:

If the

existing local industries are exposed to foreign competition they will be

ruined and thereby rate of unemployment will increase. Protection establishes

and enhances employment opportunities.

4.

Conservation of Resources Argument:

Carey, Patten

and Jevons argued that in absence of restrictions free trade transfers the

resources from a particular country to other countries. Moreover, the exporter

of raw material loses the producers profits. Protection consumes the local

natural and mineral resources.

5.

Defence Argument:

Defence is

better than opulence or guns are better than butter. These are the arguments in

favour of defence protection provides the opportunity to develop the defence

industries and to curtail dependence on other countries. Free trade thrusts

overdependence.

6.

Revenue Argument:

Protection

import duties may be the source of revenues for the government. Custom duties

have been fairly productive all over the world.

7.

Key Industry Argument:

Efforts for

economic development will be useless in the absence of basic or key industries.

For example, no economic and structural development is possible without

development of iron and steel industry. Since basic industries are crucial and

strategic therefore, they must be provided with necessary protection.

8.

Balance of Payment Argument:

An adverse

balance of payments is a root cause of various economic problems, therefore,

check on imports, through different protective tariffs, becomes necessary to

rectify adverse balance of payments.

Forms

of Restrictions:

Protectionism

may take various forms which can be discussed in terms of trade barriers as

under:

1.

Import Prohibition:

Sometimes,

certain commodities are prohibited to import by law and if they are allowed to

import, they are allowed under certain conditions. Sometimes, some countries

curtail imports by way of refusing to export some raw materials unless they are

processed at home.

2.

Exchange Control:

It is a

system of government through which it regulates the foreign exchange. All the

purchasing and selling of foreign currencies are handled by the government.

Through exchange control, the government can rectify an adverse balance of

payments by restricting and curtailing imports. Under this system, a limited

amount of foreign exchange is permitted to consume on imports

3.

Import Licences:

Under the

system, importers are only permitted foreign currency to pay for imports

sanctioned by the monetary authorities. In such cases, licences have to be

obtained before goods can be imported. Similarly, where imports of certain

goods are subject to quota restrictions such goods can be imported only by

importers who have obtained the necessary import licences.

4.

Import Monopolies:

The

government, sometimes, can make a monopoly to import some goods. It is termed

as “State Monopoly” for imports.

5.

Quota System:

With

reference to international trade, quotas have been used as an alternative to

tariffs as a means of restricting imports. A country may allot quotas to its

suppliers, by fixing a maximum amount of commodity can be imported during a period.

There are

two kinds of quota: Custom quota and Import quotas. Custom quota allows a

certain amount of a commodity to import at a favourable duty and beyond this,

normal duty is charged on the other. Import quotas are more serious in nature.

According to this type of quotas, an arbitrary limit of import is fixed beyond

which imports during a time are not allowed at all.

Advantages

of Quotas (on Imports):

The quota

system is advantageous because:

(a) It is visible

in nature.

(b) Home

manufacturers are aware of the amount to be imported and can

regulate their production accordingly.

(c) Quotas

are less resented.

(d) This

can be used as bargaining counters in trade negotiations.

Disadvantages

of Quotas:

The quota

system is also subject to following the demerits:

(a) Home

market becomes isolated and thereby is not benefited by price

oscillation outside the country.

(b) Government

loses its revenues.

(c) Quota

system concentrates undue power in the hands of

administrative officials.

6.

Protective Tariffs:

Tariff is a

schedule of charges for goods and services. But more correctly, a system of

duties imposed on goods imported (or exported) either for revenue purposes of

for protection of both. It is also defined as the tax levied on the imports.

The tariff

can be classified into two: Prohibitive tariffs and non-prohibitive tariffs.

The first type is so light that it completely discourages any import. The

second type injures but not kills off the trade.

Effects

of Tariffs:

Tariff, no doubt,

is an important tool of commercial policy with which a government can regulates

its balance of payments in favour through controlling imports. It is a double

edged weapon; on the one hand it restricts the consumption based on imports and

on the other, it can ship the use of resources from one to the other. The

effect of tariffs is to change the relative prices of goods and services and to

change the relative prices of factors of productions. Have a glance over the

diagram:

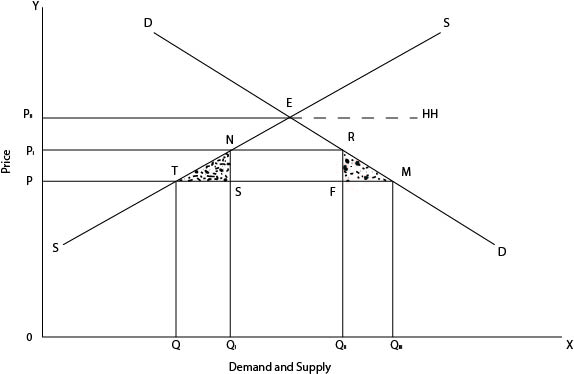

The diagram shows demand and supply (domestic) along x-axis while price along y-axis. SS and DD are the supply and demand curves respectively. Before the tariff is imposed, domestic demand is OQIII and domestic supply is OQ is and the price is OP. At this price, demand (OQIII) exceeds the supply (OQ) before the gap is filled by imports equal to QQIII.

You know

that the tariff of PPI is imposed. Since at OP price the imports

have infinite elasticity, they will have no effect of tariff. But it will raise

the price from OP to OPII in domestic market. At OPI

price, foreign supply line is shifted to PHH and imports are reduced from QIQIII

to QIQII (=NR).

Consequently, the domestic production increased from OQ to OQI

(or by QQI).

Tariffs

bring about the following effects:

(a)

Consumption Effect:

Tariffs

curtail consumption through increase in price. When tariffs are imposed, price

increased to the extent of tariffs amount. In the preceding diagram, imposition

of tariff by PPI decreases consumption from OQIII to OQII.

(b)

Redistribution effect:

Imposition

of tariffs reduces consumers’ surplus because it increases prices.

Consequently, some income is transferred from consumers to the producers and to

the income is redistributed. In the diagram this effect is illustrated by

quadrilateral PTNPI.

(c)

Protective effect:

As a result

of tariffs imposition, prices of imports become high so the imports are

curtailed. Decrease in imports provides protection to the local producers.

Protective effect increases domestic output as it is shown from OQ to OQI.

(d)

Revenue effect:

If the rate

of tariff is multiplied by the total quantity imported during a time,

government revenue can be calculated. Revenue effect is given in the diagram

equal to NSFR.

Source: Saeed Ahmed Siddiqui

No comments:

Post a Comment