Economic Development

Economic development is fundamentally about enhancing a nation’s factors of productive capacity, i.e., land, labour, capital, and technology, etc. By using its resources and powers to reduce the risks and costs, which could prohibit investment, the public sector often has been responsible for setting the stage for employment-generating investment by the private sector. The public sector generally seeks to increase incomes, the number of jobs, and the productivity of resources in regions, states, counties, cities, towns, and neighbourhoods. Its tools and strategies have often been effective in enhancing a community's:

-

labour force (workforce preparation, accessibility, cost)

-

infrastructure (accessibility, capacity, and service of basic utilities, as well as transportation and telecommunications)

-

business and community facilities (access, capacity, and service to business incubators, industrial/technology/science parks, schools/community colleges/universities, sports/tourist facilities)

-

environment (physical, psychological, cultural, and entrepreneurial)

-

economic structure (composition)

-

Institutional capacity (leadership, knowledge, skills) to support economic development and growth.

However, there can be trade-offs between economic development's goals of job creation and wealth generation. Increasing productivity, for instance, may eliminate some types of jobs in the short-run. Economic development encompasses a broad and expansive set of activities and tools that assist communities in growth and prosperity. The best economic development practitioners strive to bring quality jobs, new businesses and increased services (along with numerous other benefits) to communities through innovative approaches and outcome driven strategies.

Technology development has added a new dimension to the role of economic development professionals. The quest for increased technology can be confusing and challenging from many perspectives. Communities must judge to what extent they should strive to recruit and support the technology industry, how to determine the proper role of advanced technology on the organization’s everyday activities and design ways to help local businesses tap into technology opportunities. Many communities have been able to incorporate technology into both their practices and programs while others have struggled to understand the capabilities of this industry. As the information age and technology sector maintain steady growth, the need for more advanced economic development activity is expanding as well. Technology development encompasses increased infrastructure capabilities, advanced financing options, innovative marketing processes and start-up business assistance.

Economic Development vs. Economic Growth

-

Development is a qualitative change, which entails changes in the structure of the economy, including innovations in institutions, behaviour, and technology

-

Growth is a quantitative change in the scale of the economy - in terms of investment, output, consumption, and income.

According to this view, economic development and economic growth are not necessarily the same thing. First, development is both a prerequisite to and a result of growth. Development, moreover, is prior to growth in the sense that growth cannot continue long without the sort of innovations and structural changes noted above. But growth, in turn, will drive new changes in the economy, causing new products and firms to be created as well as countless small incremental innovations. Together, these advances allow an economy to increase its productivity, thereby enabling the production of more outputs with fewer inputs over the long haul. Environmental critics and sustainable development advocates, furthermore, often point out that development does not have to imply some types of growth. An economy, for instance, can be developing, but not growing by certain indicators. Indeed, the measure of productivity should not be solely monetary; it should also address the issues like how effectively scarce natural resources are being used? How well pollution is being reduced or prevented? Etc.

Stages of Economic Development

Professor W.W. Rustow has defined and analysed in his book ‘The stages of economic growth’, the five stages of economic development:

1. The traditional society: In the traditional long-lived social and economic system, the output per head is very low and tends not to rise. There are still few examples of traditional societies in this 21st century, that is, Afghanistan, Somalia, Ethiopia, etc.

2. The pre-conditions for take-off: sometimes also referred to ‘preparatory period’. It covers a long period of a century or more during which the preconditions for take-off are established. These conditions mainly comprise fundamental changes in the social, political and economic fields; for example, (i) a change in society’s attitudes towards science, risk-taking and profit-earning, (ii) the adaptability of the labour force; (iii) political sovereignty; (iv) development of a centralised tax system and financial institutions; and (v) the construction of certain economic and social overheads like rail roads and educational institutions.

3. The take-off stage: This is the crucial stage which covers a relatively brief period of two or three decades in which the economy transforms itself in such a way that economic growth subsequently takes place more or less automatically. The take-off is defined as the interval during which the rate of investment increases in such a way that real output per capita rises and this initial increase carries with it radical changes in the techniques of production and the disposition of income flows which perpetuate the new scale of investment and perpetuate thereby the rising trend in per capita output.

4. The drive to maturity: It is the stage of increasing sophistication of the economy. Against the background of steady growth, new industries are developed, there is less reliance on imports and more exporting activity. The economy demonstrate its capacity to move beyond the original industries which powered its takeoff, and to absorb and to apply efficiently the most advanced fruits of modern technology.

5. The stage of mass production and mass consumption: The fourth stage ends in the attainment of fifth stage, which is the period of mass production and consumption. The economy is characterised by affluent population, availability of durable and sophisticated consumer goods, hi-tech industries, and production of diversified goods and services. USA, UK, Canada, France, Germany, Japan, Spain, Italy, etc are the examples.

Characteristics of Developing Economies

A developing country is one with real per capita income that is low relative to that in industrialised countries like US, Japan and those in Western Europe. Developing countries typically have population with poor health, low levels of literacy, inadequate dwellings, and meagre diets. Life expectancy is low and there is a low level of investment in human capital.

1. Deficiency of capital: One indication of the capital deficiency is the low amount of capital per head of population. Shortage of capital is reflected in the very low capital-labour ratio. Not only is the capital stock extremely small, but the current rate of capital formation is also very low, which is due to low inducement to invest and to the low propensity to save. Thus low level of per capita income limits the market size.

2. Excessive dependence on agriculture: Most of the less-developed countries are agrarians. In Pakistan, most of the people are engaged in agriculture. Whereas in developed countries 15% of the population is engaged in agriculture. The excessive dependence on agriculture in less developed countries is due to the fact that non-agricultural occupations have not grown in proportion with the growth in population. Hence, the surplus labour is to be absorbed in agriculture.

3. Inequalities in the distribution of income and wealth: In under-developed countries, there is a concentration of income in a few hands. In other terms, the income is insufficient to meet the requirements of the whole economy. Such income is diverted to non-productive investments such as jewellery and real-estates, and unproductive social expenditure.

4. Dualistic economy: Dualistic economy refers to the existence of two extreme classes in an economy, particularly less-developed economy. There are old and new production methods, educated and illiterate population, rich and poor, modern and backward, capitalists and socialists, donkey carts and motor cars existing side by side. This situation creates an atmosphere of great conflict and contradiction, and hampers the economic development in the long-run.

5. Lack of dynamic entrepreneurial abilities and highly skilled labour

6. Inadequate infrastructure: like airports, rail roads, highways, overheads, bridges, telecommunication facilities, sewerage and drainage, power generation, hospitals, etc.

7. Rapid population growth and disguised unemployment

8. Under-utilisation of natural resources

9. Poor consumption pattern: In less-developed countries, most of the people’s income is spent on basic necessities of life. They are too poor to spend on other industrial goods and services.

Determinants of Economic Growth

(Factors of Economic Development in UDCs / Reasons of Failure of Under-Developed Countries)

The process of economic development is a highly complex phenomenon and is influenced by numerous and varied factors, such as political, social and cultural factors. The supply of natural resources and the growth of scientific and technological knowledge also have a strong bearing on the process of economic development. From the standpoint of economic analysis, the most important factors determining the rate of economic development are:

1. Availability of natural resources: The availability and use of natural resources within a country play a vital role in the economic development. Many poor countries have enormous amount of natural resources, but they are failed to explore them. The reason is that the government has not provided necessary incentives to the farmers and landowners to invest in capital and technologies that will increase their land’s yield. In natural resources, minerals, oil and gas, forests, oceans and seas, livestock, land’s fertility, and mountains are generally included. It must be noted here that the existence of natural resources is not a sufficient condition of economic growth. Many poor and under-developed countries are rich with natural resources but there is a problem of availability of capital required for their extraction. Such countries include Pakistan, India, Afghanistan, and several African and Latin American countries.

2. Rate of capital formation: The second important factor of economic development is the rate of capital formation. Keynes also ascribed the economic development of Europe to the accumulation of capital. According to him, Europe was so organised socially and economically as to secure the maximum accumulation of capital. The crux of the problem of economic development in any under-developed country lies in a rapid expansion of the rate of its capital investment so that it attains a rate of growth of output which exceeds the rate of growth of population by a significant margin. Only with such a rate of capital investment will the living standards begin to improve in a developing country.

Capital formation or inducement to invest depends on the propensity to save. In less-developed countries, there is a very low saving tendency because of low income. Developed countries managed to save 20% of their output in capital formation. Whereas only 5% of the national income is saved in UDCs. Much of the savings goes to housing and basic needs and, therefore, a very small amount is left over for development.

Capital formation is the basic tool for economic development. It may take decades to invest in building up a country’s infrastructure, information technologies, power-generating plants, and other capital goods industries. Developing countries must have to build up their infrastructure, or social overhead capital in order to set path for economic glory.

If there are so many obstacles in finding domestic savings for capital formation, then the country depends on foreign sources of funds. Less-developed countries have to welcomed the flow of foreign capital or foreign borrowings. As long as the exports of these countries grew at the same rate as borrowings, it is a favourable condition. But several poor countries needed all their earnings simply to pay interest on their foreign debts. This is an adverse situation. Such countries need to boost up their production in order to cope with their current indebtedness.

3. Capital-output ratio: Apart from the ratio of capital formation to the aggregate national income, the growth of output depends upon the capital-output ratio. The capital-output ratio may be defined as the relationship of investment in a given economy or industry for a given time period to the output of that economy or industry for a similar time period. The productivity of capital depends on many factors such as the degree of technological development associated with capital investment, the efficiency of handling new types of equipment, the quality of managerial and organisation skill, the existence and the extent of the utilisation of economic overheads and the pattern and rate of investment. For instance, the higher the proportion of investment devoted to the production of direct commodities, the lower the capital-output ratio, and higher the proportion of investment devoted to public utilities, i.e., economic and social overheads, the higher shall be the capital-output ratio, and vice versa. Higher the investment devoted to heavy industry, the higher will be the capital-output ratio, and vice versa. Higher the rate of investment and greater the technological progress, the lower will be the capital-output ratio. The capital-output ratio also varies with the prices of inputs.

4. Technological progress: The key to economic development for any country is the technological progress. Greater the technological progress, the higher will be the economic progress. The great importance of technological progress in the economic progress of Western European countries was recognised by Karl Marx himself. The technological progress of a country includes development in research and development, means of transportation, telecommunication, energy-generation, oil and gas exploration, information technologies, integrated circuits manufacturing, etc. Again, without capital formation, the technological progress is impossible, because building huge hi-tech industries requires a huge investment and a favourable economic condition.

5. Dynamic entrepreneurship: The modern economists recognise the dynamic role of entrepreneurs in promoting the economic growth of the country. The efficient utilisation of entrepreneurial skills can only be ensured when there is presence of considerable profit motive. The entrepreneur maximises his profit by making innovations, i.e., by bringing out a new product, new technologies, new product lines, new market, new sources of raw materials and by adopting an optimum combination of factors of production. Thus he is making the most significant contribution in the national income and in the technological progress.

The private enterprises in UDCs like India and Pakistan, has not taken them any far on the road of economic development. There is a lacking of entrepreneurial skills in under-developed countries. There is a lack of innovation. Entrepreneurs are more attracted by commerce than by industries. So it becomes the government’s duty to ensure the supply of required type of entrepreneurship.

6. Human Resources: Besides efficient entrepreneurs, the economic development of a country depends on the supply of skilled and semi-skilled labour, and requires government’s greatest contribution to the development of human resources. The development of human resources depends on the availability of hygienic food; quantity and quality of education centres and health centres; clean water; means of transportation and communication; entertainment; counselling services; loan facilities; scholarship; job security and old age benefits; etc.

In poor countries GDP rises but at the same time the population also grows. Several developing countries are facing high birth rates with stagnant national income per head. It is hard for poor countries to overcome poverty with birth rates so high. In under-developed countries, the economic planners emphasise the following specific programmes:

(a) Control disease and improve health and nutrition,

(b) Improve education, reduce illiteracy and train workers, and

(c) Ensure that the labour force is well-equipped with necessary and competing skills.

7. Rate of growth of population: The size and rate of population growth has an important bearing on the economic development of a country. A rapidly growing population aggravates the food problem, worsens the unemployment situation, adds to the number of unproductive consumers, keeps down per capita income and labour efficiency, and militates against capital formation. A rapid rate of population growth acts like a drag on economic development and slows down the pace of economic growth.

8. Price Mechanism: In under-developed economies, a very little emphasis is placed on price mechanism. The disequilibrium of prices has severe consequences on the efficiency of the economy. The resource utilisation becomes lack of optimality. The productive machinery of the community is hampered. There is no guarantee as regard to the quantity and quality of the production.

In order to speed up the economic development, price mechanism must go or confined to unimportant sectors of the economy like the purchase and sale of consumer goods.

9. Non-economic factors: Non-economic factors include social factors, demographical factors, institutional factors and political factors. The economic development depends on the political sovereignty, the complexion and competence of government, quality of administration, and political ideology of government.

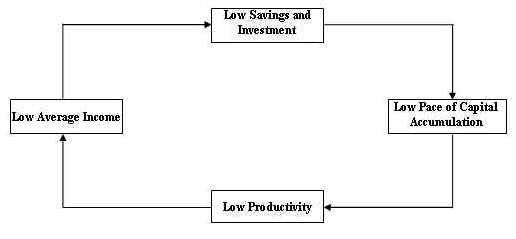

Vicious Cycle of Poverty

Many developing countries are caught up in vicious cycle of poverty. Low level of income prevents savings, retards capital growth, hinders productivity growth, and keeps income low. Successful development may require taking steps to break up the chain at many points. Other points in poverty are also self-reinforcing. Poverty is accompanied by low levels of education, literacy and skill; these in turn prevent the adaptation to new and improved technologies and lead to rapid population growth. The vicious cycle of poverty is depicted as below:

Approaches to Economic Development

The following approaches are developed in recent years to explain the economic development and answer the question how countries break out of the vicious cycle of poverty to virtuous circle of economic development:

1. The Take-off Approach: Take-off is one of the stages of economic growth. Different economies have been benefited from ‘take-off’ approach in different periods, including England at the beginning of eighteenth century, the United States at the mid of nineteenth century, and Japan in early twentieth century. The take-off is impelled by leading sectors such as a rapid growing export market or an industry displaying large economies of scale. Once these leading sectors begin to flourish, a process of self-sustained growth (i.e. take-off) occurs. Growth leads to profits, profit are reinvested, capital, productivity and per capita income spur ahead. The virtuous cycle of economic development is under way.

2. The Backwardness Hypothesis and Convergence: The second approach emphasises the global context of economic development. Poor countries have important advantages that the pioneers of industrialisation had not. Developing nations can draw upon the capital, skills and technologies of advanced countries. Developing countries can buy modern textile machinery, efficient pumps, miracle seeds, chemical fertilisers and medical supplies. Because they can lean on the technologies of advanced countries. Today’s developing nations can grow more rapidly than Great Britain, Western European Countries and United States in past. By drawing upon more productive technologies of the leaders, the developing countries would expect to see convergence towards the technological frontier.

3. Balanced Growth: Some writers suggest that growth is a balanced process with countries progressing steadily ahead. In their view, economic development resembles the tortoise making continual progress, rather than the hare, who runs in spurts and then rats when exhausted. Simon Kuznets examined the history of thirteen advanced countries and conceived that the balanced growth model is most consistent with the countries he studied. He noticed no significant rise or fall in economic growth as development progressed.

Note one further important difference between these approaches. The ‘take-off’ theory suggests that there will be increasing divergence among countries (some flying rapidly, while others are unable to leave the ground). The ‘backward’ hypothesis suggests ‘convergence’, while the ‘balanced-growth’ model suggests roughly ‘constant’ differentials. In the following diagrams, advanced countries are represented by curve A, middle income countries by curve B and low-income countries by curve C. The curves show per capita income:

Strategies of Economic Development

Following are the strategies commonly applied in economic planning:

1. Balanced vs. Unbalanced Growth: Currently there are two major schools of thoughts regarding the process of growth, i.e., balanced growth strategy and unbalanced growth strategy:

(a) Balanced Growth Strategy: Economists like Ragnar Nurkse and Rosenstsein-Rodan strongly advocate balanced growth strategy. According to them, the pattern of investment should be so designed as to ensure a balanced development of the various sectors of the economy. They advocate simultaneous investment in a number of industries so that there is a balanced growth of different industries.

(b) Unbalanced Growth Strategy: Economists like H.W. Singer and A.O. Hirschman, on the other side, believe that rapid economic growth follows ‘concentration’ of investment in certain strategic industries rather than an even distribution of investment among the various industries. In the view of these economists, unbalanced growth is more conducive in economic development than a balanced one.

2. Big-Push Strategy: The big-push strategy is associated with the name of Rosenstein-Roden and Harvey Leibenstein. It is contended that a big-push is needed to overcome the initial inertia of a stranger economy. Rosenstein-Roden observes that there is a minimum level of resources that must be devoted to a development programme if it is to have any chance of success. Launching a country into self-sustaining growth is like getting an airplane off the ground. There is critical ground speed which must be passed before the craft can become airborne.

3. Balanced, Unbalanced and Big-Push (BUB) Strategy: The advocates of this strategy suggest that no single strategy will take us to the goal of economic development. Not only has the strategy to be changed from time to time as the situation may require, but it may be necessary sometimes to strike a balance between the alternative strategies. In the initial stage, which is characterised by unbalances, counter-unbalance strategy is to be adopted. But once an appropriate balance is attained by a fair dose of big-push, the strategy of balanced growth may be applied to further planning.

Issues in Economic Development

Following are the important issues in under developed countries:

1. Industrialisation vs. Agriculture: In most countries, incomes in urban areas are almost more than double in rural areas. Many nations jump to the conclusion that industrialisation is the cause rather than effect of affluence. To accelerate industrialisation at the expense of agriculture has led many analysis to rethink the role of farming. Industrialisation tends to be capital intensive, attract workers into crowded cities, and often produces high level of unemployment. Rising productivity on farms may require less capital, while providing productive for surplus labour.

2. Inward vs. Outward Orientation: This is a fundamental issue of economic development towards international trade. Should the developing countries be self-sufficient? If yes, the country has to replace imported goods and services with domestic production. This strategy is known as ‘import substitution’ or ‘inward orientation’.

If the country decides to pay for imports it needs by improving efficiency and competitiveness, developing foreign markets, and giving incentives for exporters. This is called ‘outward orientation’ strategy. It is generally observed that by subsidising import substitution, competition is limited, innovation is dampened, productivity growth is slow down and country’s real income falls to a lower level. Whereas, the outward orientation sets up a system of incentives that stimulates exports. This approach maintains a competitive FOREX rate, encourages exports, and minimises unnecessary government regulation of businesses esp. small and medium sized firms.

3. State vs. Market: The cultures of many developing countries are hostile to the operation of markets. Often competition among firms or profit seeking behaviour is contrary to traditional practices, religious beliefs, or vested interest. Yet decades of experience suggest that extensive reliance on markets provides the most effective way of managing an economy and promoting rapid economic growth.

The government has a vital role in establishing and maintaining a healthy economic environment. It must ensure law and order, enforce contracts, and orient its regulations towards competition and innovation. The government plays a leading role in investment in human capital through education, health and transportation, but the government should minimise its intervention or control in sectors where it has no comparative advantage. Government, should focus its efforts on areas where there are clear signs of market failure.

No comments:

Post a Comment